Personal Loans Canada Fundamentals Explained

Personal Loans Canada Fundamentals Explained

Blog Article

More About Personal Loans Canada

Table of ContentsSome Ideas on Personal Loans Canada You Should KnowPersonal Loans Canada Can Be Fun For EveryoneMore About Personal Loans CanadaPersonal Loans Canada Fundamentals ExplainedThe Basic Principles Of Personal Loans Canada

Payment terms at a lot of individual loan lending institutions vary between one and seven years. You get all of the funds at as soon as and can use them for almost any type of purpose. Consumers often use them to fund a property, such as a car or a boat, settle debt or assistance cover the price of a significant expenditure, like a wedding celebration or a home restoration.

A fixed price offers you the security of a foreseeable month-to-month payment, making it a prominent choice for settling variable rate credit score cards. Repayment timelines vary for individual fundings, yet consumers are frequently able to choose payment terms in between one and 7 years.

The smart Trick of Personal Loans Canada That Nobody is Discussing

You might pay a first origination fee of approximately 10 percent for a personal funding. The fee is normally subtracted from your funds when you complete your application, lowering the amount of cash you pocket. Individual lendings rates are extra straight tied to short-term rates like the prime rate.

You may be offered a reduced APR for a shorter term, because lending institutions recognize your equilibrium will be repaid much faster. They may charge a greater price for longer terms recognizing the longer you have a finance, the more probable something could alter in your funds that can make the settlement unaffordable.

A personal lending is additionally an excellent alternative to using charge card, considering that you obtain cash at a fixed rate with a definite reward date based upon the term you pick. Bear in mind: When the honeymoon mores than, the month-to-month repayments will be a tip of the money you invested.

The Best Guide To Personal Loans Canada

Prior to tackling debt, use a personal finance settlement calculator to help budget plan. Gathering quotes from numerous lenders can aid you find the most effective bargain and possibly save you passion. Contrast rate of interest, costs and lending institution online reputation before requesting the funding. Your credit history is a large consider establishing your qualification for the funding in addition to the rates of interest.

Prior to using, recognize what your score is to make sure that you recognize what to anticipate in regards to expenses. Be on the hunt for surprise fees and fines by reviewing the loan provider's terms and conditions page so you don't end up with less cash than you need for your financial objectives.

They're less complicated to qualify for than home equity fundings or other protected lendings, you still need to show the lender you have the methods to pay the car loan back. Individual fundings are far better than Recommended Site credit report cards if you desire a set monthly repayment and require all of your funds at when.

How Personal Loans Canada can Save You Time, Stress, and Money.

Credit history cards might additionally use benefits or cash-back choices that personal financings don't.

Some loan providers may also charge costs for individual loans. Individual fundings are financings that can cover a number of individual costs.

As you invest, your offered credit is minimized. You can after that raise available credit by making a payment toward your debt line. With an individual funding, there's typically a set end day by which the lending will certainly be repaid. A line of credit, on the other hand, may remain open and offered to you indefinitely as lengthy as your account continues to be in good standing with your loan provider - Personal Loans Canada.

The money gotten on the lending is not tired. If the lender forgives the financing, it is thought about a canceled financial debt, and that amount can be More Bonuses tired. A safeguarded individual funding requires some type of security as a problem of borrowing.

Fascination About Personal Loans Canada

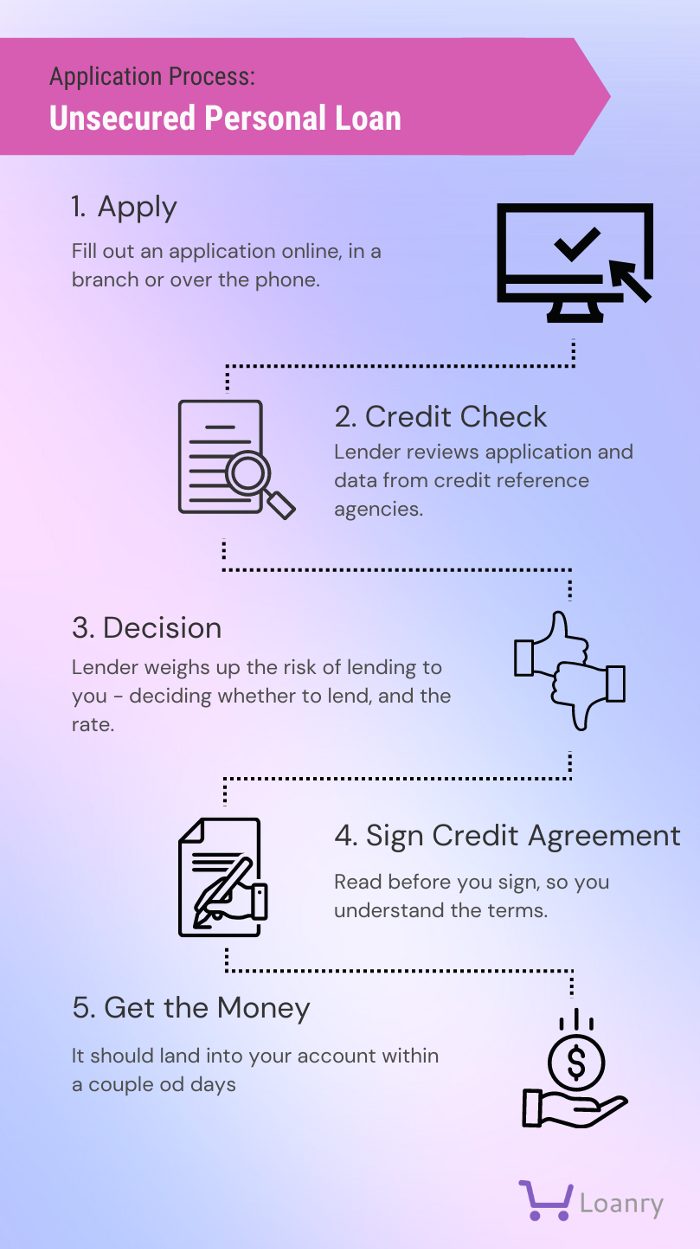

An unsecured personal car loan requires no collateral to obtain cash. Banks, debt unions, and online lenders can provide both safeguarded and unsecured personal loans to qualified consumers.

Once again, this can be a bank, credit score union, or on the internet individual financing lender. If accepted, you'll be offered the car loan Look At This terms, which you can approve or reject.

Report this page